BLOG

ブログ

BLOG

Order Book Dynamics: Understanding Market Depth

Understanding Market Depth in Cryptocurrency Markets: A Deep Dive into Order Book Dynamics

The world of cryptocurrency has experienced rapid growth and volatility in recent years, with prices fluctuating rapidly between market highs and lows. One critical factor that influences the price movements is the depth of the order book, which refers to the number of buy and sell orders present at any given moment. In this article, we’ll delve into the concept of market depth and its implications for cryptocurrency markets.

What is Market Depth?

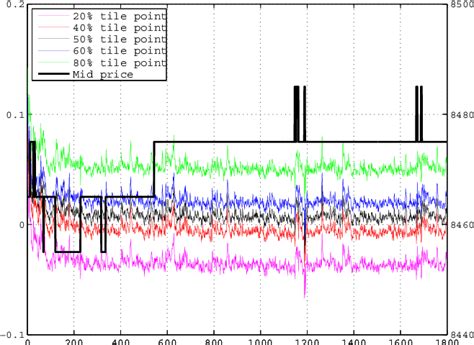

Market depth refers to the total number of buy and sell orders competing in a specific price interval (e.g., $1,000 or $10) within a time frame (e.g., one hour). It’s essentially an indicator of liquidity and market activity. A deep order book indicates that there are many buyers and sellers actively interacting with each other to settle trades, which can lead to more informed trading decisions.

Types of Market Depth

There are three primary types of market depth:

- Low Market Depth (LMD): Fewer than 10 buy and sell orders competing in a specific price interval.

- Medium Market Depth (MMD): Between 20-100 buy and sell orders competing in the same price interval.

- High Market Depth (HMD): More than 200 buy and sell orders competing in the same price interval.

Order Book Dynamics

The order book dynamics refer to how different types of orders interact with each other in a market, influencing the price movement. Here are some key aspects:

- Buy-Sell Imbalance: The difference between the number of buy orders (B) and sell orders (S). A balanced market is one where B = S.

- Order Flow: The speed at which buy and sell orders interact with each other, determining price movements.

- Order Leverage: The relationship between buy and sell prices. Higher leverage can amplify price fluctuations.

Characteristics of High-Market-Depth Markets

Cryptocurrency markets exhibit high market depth characteristics, such as:

- Increased liquidity: More buy and sell orders lead to more informed trading decisions, increasing overall liquidity.

- Price stability: High market depth can help stabilize prices by reducing the impact of large price movements.

- Improved risk management: With more buyers and sellers participating, it’s easier for traders to manage their positions.

Factors Affecting Market Depth

Several factors influence market depth:

- Trading volume: Higher trading volumes increase the number of buy and sell orders competing in a specific price interval.

- Order types: Different types of orders (e.g., limit orders, stop-loss orders) have varying impact on order flow and market depth.

- Market conditions: Economic indicators, such as GDP growth rates or inflation rates, can affect market sentiment and lead to changes in order book dynamics.

Conclusion

Understanding market depth is crucial for traders and investors in cryptocurrency markets. High-market-depth markets provide more informed trading decisions, increased liquidity, and improved risk management. As the cryptocurrency space continues to evolve, it’s essential to stay up-to-date with the latest developments in order book dynamics and market depth to make the most of this valuable information.

Recommendations for Trading Cryptocurrencies

- Monitor order books

: Keep track of market depth and order flow to identify potential trading opportunities.

- Diversify your portfolio: Spread your investments across multiple cryptocurrencies and asset classes to minimize risk.

- Stay informed: Stay up-to-date with the latest news and analysis to make informed trading decisions.