BLOG

ブログ

BLOG

Technical Analysis Techniques For Crypto Traders

Technical Analysis Techniques for Cryptocurrency Traders

Cryptocurrency Trading has became incredited in recent years. In this article, we will explore some of the most effective technical analysis techniques used by cryptocurrency traders.

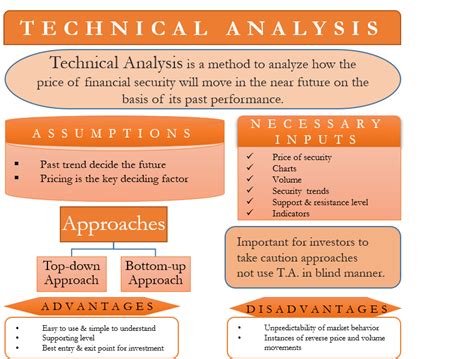

Understanding Technical Analysis

Before diving into the technical analysis techniques for cryptocurrency traders, it is essential to understand what technical analysis is. Technical Analysis Involves Analyzing Historical Price Data and Chart Patterns to Predict Future Market Movements. It

Indicators for Cryptocurrency Trading

Several indicators have been developed specifically for cryptocurrency trading, including:

* Relative Strength Index (RSI) : A Momentum Indicator That Measures A Security’s Recent Price Changes. When the RSI falls below 30, it may indicate overbought conditions.

* Moving Average Convergence Divergence (MACD) : A Technical Indicator that plots the difference between two moving acrossage. The macd can be used to identify trends and identify potential support and resistance levels.

* Bollinger Bands : A volatility-based indicator that plots the standard deviation of price changes. Bollinger Bands are used to detect overbought and oversold conditions.

Chart Patterns for Cryptocurrency Trading

Cryptocurrency Prices Follow Various Chart Patterns, Including:

* Head and shoulders : a pattern formed by a peak and a trough, often indicating potential reversals.

* Triangles : Triangles can be used to identify support and resistance levels.

* Engulfing Patterns : Shallow Triangles or Wedges Where the Upper and Lower Bands are equal, indicating potential Reversals.

Other Technical Analysis Techniques

Cryptocurrency Traders also use other technical analysis techniques, including: including:

* Time Series Analysis : Analyzing Historical Price Data Over Time to Identify Trends and Patterns.

* Moving Average Crossover Trading :

* Support and Resistance levels : Identifying potential support and resistance levels by analyzing previously prices.

Best Practices for Using Technical Analysis Techniques

To get the most out of technical analysis techniques, traders should follow these best practices:

* use a combination of indicators : combining multiple indicators can provide more attainment results than using any one indicator.

* Focus on charts with Clear Patterns : Choosing charts with clear and recognizable patterns is essential for identifying trading opportunities.

* Stay up-to-date with market news and events : market analysis is only as the information available, so

Conclusion

Technical Analysis Techniques are a valuable tool for cryptocurrency traders seeking to identify potential trading opportunities. By mastering these techniques, traders can increase their chances of success in this volatile asset class. Remember to always promptable, as